BREAKING: NSITF Chairman in N297 Billion Scandal, operates over 100 Bank Accounts [DOCS]

Fresh allegations have surfaced against the Managing Director and Chief Executive Officer of the Nigeria Social Insurance Trust Fund (NSITF), Oluwaseun Mayomi Faleye, over the alleged diversion and mismanagement of workers’ compensation funds running into hundreds of billions of naira.

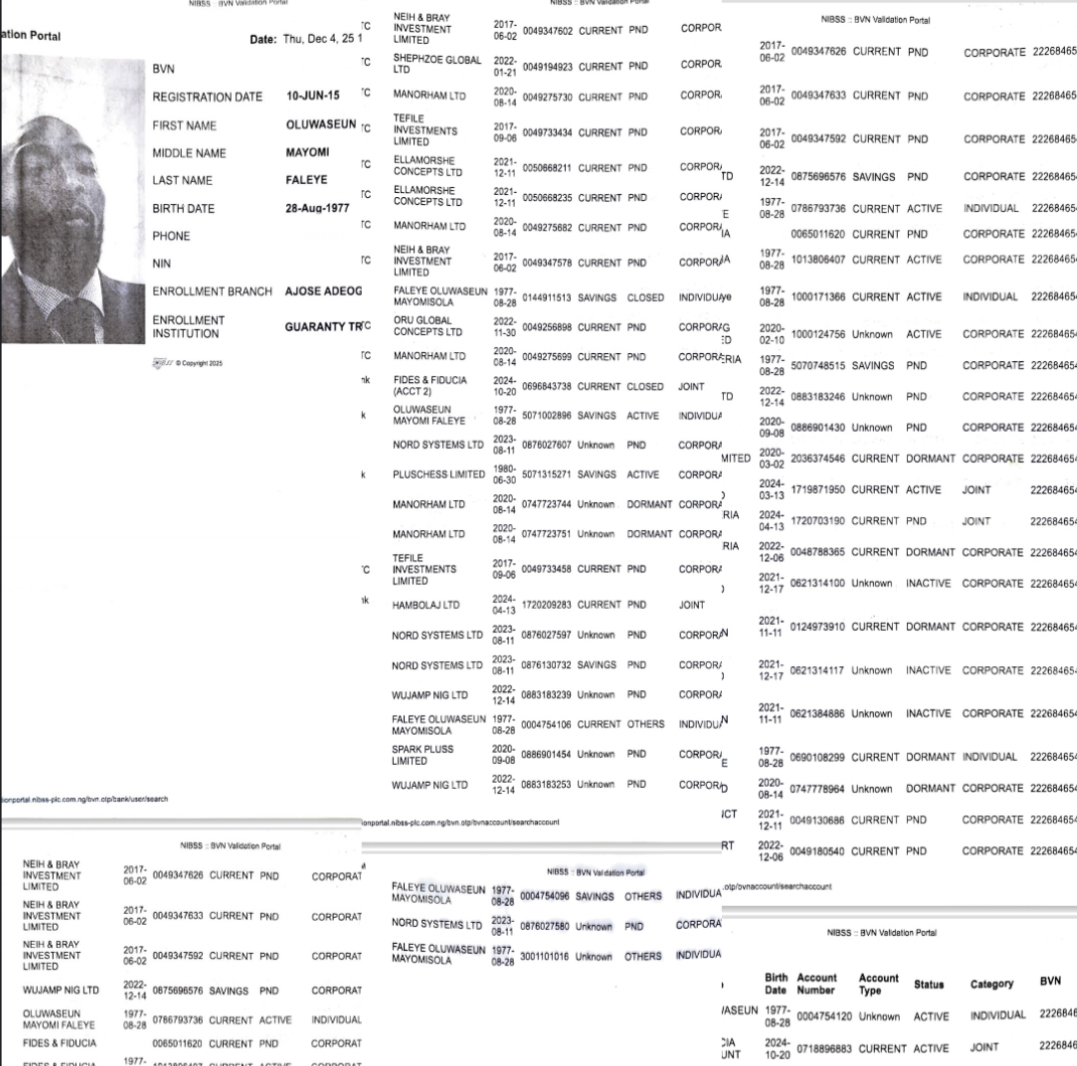

Investigative materials seen by this newspaper allege that Faleye operated more than 100 bank accounts linked to a single Bank Verification Number (BVN) and granted himself unlimited spending authority, enabling the disbursement of funds without board approval or compliance with federal financial regulations.

₦297bn Lodged, ₦243bn Spent Without Approval

Documents reviewed reportedly show that between January 2 and October 9, 2025, the NSITF recorded total lodgements of ₦297,019,145,288.60, generated entirely from mandatory employer contributions under the Employees’ Compensation Act (ECA).

Within the same period, ₦243,203,518,621.17 was allegedly spent. Multiple senior officials quoted in the report claimed that a substantial portion of the expenditure was carried out without approval from the NSITF Management Board, in violation of the Act establishing the Fund.

‘No Approval Limit’ Resolution Raises Red Flags

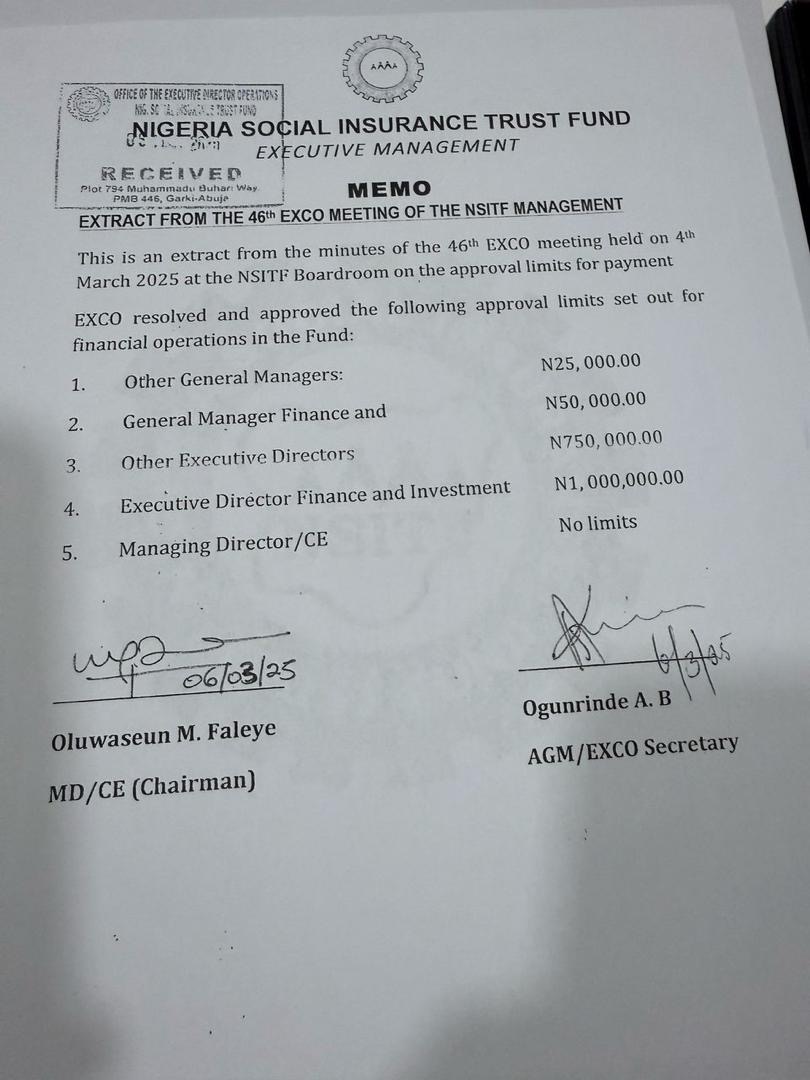

Central to this development is a document dated March 4, 2025, described as an extract from the minutes of the 46th Executive Committee (EXCO) meeting of NSITF, chaired and signed by Faleye.

While the document reportedly set approval limits for other officials —

Other General Managers: ₦25,000

General Manager (Finance): ₦50,000

Other Executive Directors: ₦750,000

Executive Director (Finance & Investment): ₦1,000,000

— it allegedly imposed no approval limit on the Managing Director/CEO.

Sources said this effectively allowed Faleye to approve payments of any amount without recourse to the Board or external oversight, contrary to existing public finance rules.

Detailed Financial Transactions Allegedly Traced

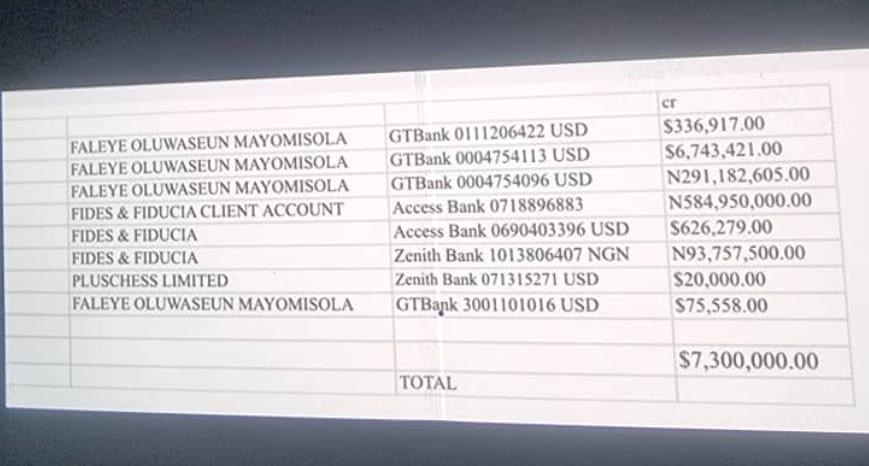

Further documents cited in the report allegedly traced significant inflows into bank accounts linked to Faleye and entities said to be associated with him. The transactions listed include:

Faleye Oluwaseun Mayomisola – GTBank USD Account 0111206422: $336,917.00

Faleye Oluwaseun Mayomisola – GTBank USD Account 0004754113: $6,743,421.00

Faleye Oluwaseun Mayomisola – GTBank NGN Account 0004754096: ₦291,182,605.00

Fides & Fiducia Client Account – Access Bank NGN Account 0718896883: ₦584,950,000.00

Fides & Fiducia – Access Bank USD Account 0690403396: $626,279.00

Fides & Fiducia – Zenith Bank NGN Account 1013806407: ₦93,757,500.00

Pluschess Limited – Zenith Bank USD Account 071315271: $20,000.00

Faleye Oluwaseun Mayomisola – GTBank USD Account 3001101016: $75,558.00

The total dollar inflow alone was estimated at over $7.3 million, excluding the naira-denominated transactions.

A source familiar with the documents said the size and frequency of the transfers suggest deliberate structuring rather than routine financial activity.

Over 100 Bank Accounts Linked to One BVN

Another document reportedly shows that more than 100 active bank accounts are linked to a single BVN registered in Faleye’s name, enrolled with Guaranty Trust Bank in 2015. Sources alleged that several of the accounts received funds traceable to NSITF operations.

“You don’t operate over 100 accounts by accident,” one official reportedly said. “This points to systematic structuring.”

₦5.53bn Commission Payments Also Queried

The investigation further alleged that Faleye authorised commission payments totalling ₦5,533,517,486.90 without approval from the NSITF Board or the Federal Ministry of Labour. The payments allegedly include:

₦1,379,186,010.00 to Assurance Services ST ADBA Ltd (October 9, 2025)

₦865,000,000.00 to TAGG Global Resources Ltd (March 18, 2025)

₦683,777,666.40 to Rate Seal Support & Project Ltd (September 17, 2025)

₦659,303,810.50 to Rate Seal Support & Project Ltd (May 16, 2025)

₦648,750,000.00 to Rate Gold Solution Nigeria Ltd (May 16, 2025)

₦648,750,000.00 to Gold Solution Nigeria Ltd (August 1, 2025)

₦648,750,000.00 to TAGG Global Resources Ltd (August 1, 2025)

Sources said the payments, reportedly ranging between 15 and 20 per cent commissions, lacked lawful approval.

Responses

When contacted, Faleye reportedly said he was not aware of the allegations. However, SaharaReporters stated that he ended the call abruptly when questioned about the dollar inflows, and subsequent efforts to reach him were unsuccessful.

The Permanent Secretary of the Federal Ministry of Labour and Employment, Salihu Usman, reportedly denied knowledge of the alleged transactions.

As of press time, NSITF had not issued an official response. The revelations have intensified calls for a forensic audit of the Fund and stricter safeguards to protect workers’ contributions under the Employees’ Compensation Scheme.