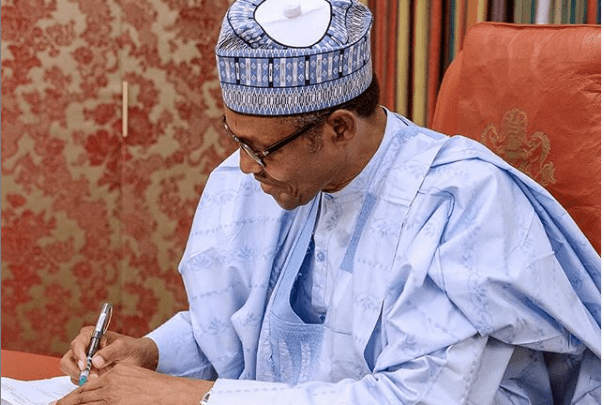

President Muhammadu Buhari on Monday signed the finance bill into law. The bill includes an increase in value-added tax (VAT) rate from 5% to 7.5%.

The bill was submitted to the National Assembly alongside the recently-passed 2020 budget.

President Buhari took to his Twitter account to express delight at the event. He said the bill will, among other things, reform Nigeria’s tax laws, align it with global best practices; support MSMEs, aid the government’s Ease of Doing Business reforms, incentivize investments in infrastructure and capital markets, and raise government revenue.

He pointed out that this is the first time since 1999 that a federal budget is accompanied by the passage of a finance bill designed to support its implementation, and to create a truly enabling environment for business and investment by the private sector.

He also commended the leadership and members of the 9th National Assembly for the hard work and support that went into the passage of the bill and the Deep Offshore and Inland Basin PSC Amendment Bill, which he said are both vital to the successful implementation of the 2020 Budget.

The law seeks to amend the Petroleum Profit Tax Act, Customs and Excise Tariff Act, Company Income Tax Act, Personal Income Tax Act, Value Added Tax, Stamp Duties Act and the Capital Gains Tax.

Having been signed into law, companies with an annual turnover of less than N25 million are now exempt from paying company income tax.

In order to increase government revenue, stamp duty will now be charged for online transactions from the current N1,000 to N10,000.