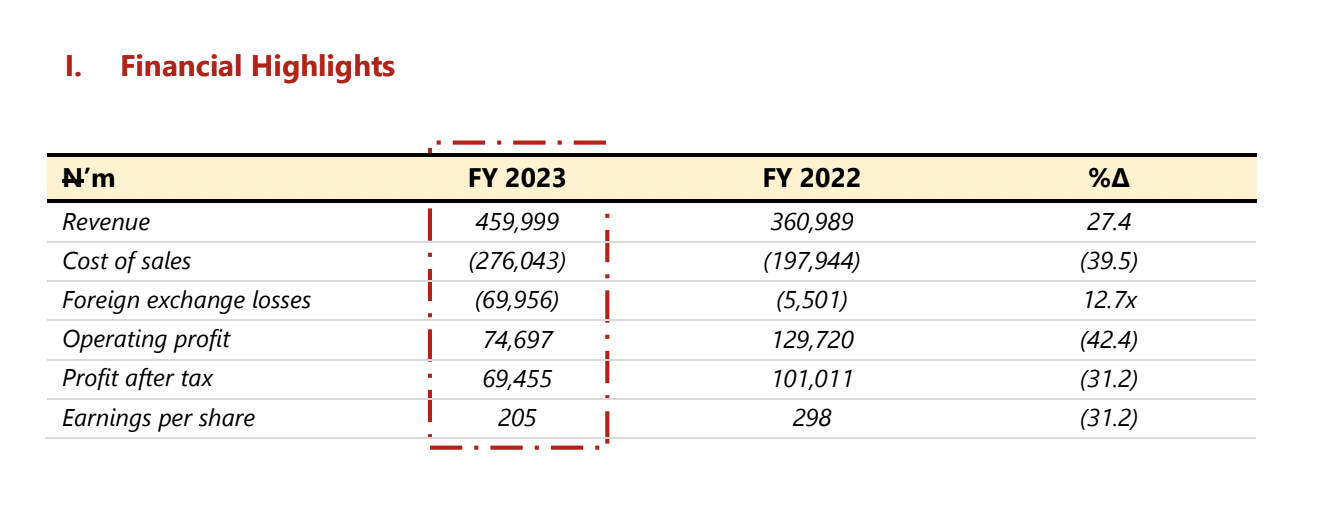

BUA Cement released its audited financial statements for the full year 2023, revealing robust revenue growth of over 27 percent, totaling N460 billion. This achievement comes amidst challenging economic conditions stemming from the Naira redesign policy.

Despite facing these significant hurdles, including Naira devaluation and persistent inflation, the company demonstrated resilience, posting a revenue growth of 27.4 percent. However, production costs soared by 39.5 percent to N276 billion, compared to N197.9 billion in 2022.

In the face of these challenges, BUA Cement reported a net foreign exchange loss of N70 billion, primarily attributed to finance costs related to the construction of additional 3mmtpa lines at its Obu and Sokoto plants, as well as foreign trade payables amounting to N17.5 billion. Nonetheless, the company managed to achieve a net profit after tax of N69.5 billion.

Yusuf Binji, the Managing Director/CEO, acknowledged the tough operating environment in 2023 but highlighted the company’s initiatives that contributed to revenue growth, including the BUA Cement Scratch and Win promo. Furthermore, the commissioning of new production lines and gas power plants at Sokoto and Obu plants, along with investments in distribution infrastructure, bolstered market presence.

Binji emphasized the company’s commitment to addressing Nigeria’s housing and infrastructure needs sustainably while striving to make cement more affordable. He also noted the completion of the new 70MW gas power plant in Sokoto and anticipated activation of the same plant in Obu during the first quarter of 2024.

In his words: “Clearly, the operating environment in 2023 was challenging, given the different headwinds confronted with at the start of the year and especially with the devaluation of the Naira. During the year, we launched the maiden edition of the BUA Cement Scratch and Win promo., among other initiatives, which saw BUA Cement further increase its share of the market and resulted to a 27.4 per cent rise in revenues to N460 billion from N361 billion in the prior year.”

“In addition, we commissioned the new 3mmtpa lines at the Sokoto and Obu Plants, activated a new 70MW gas power plant in Sokoto and eagerly await the activation of the 70MW gas power plant at Obu during the first quarter of 2024,”

Jacques Piekarski, the Chief Financial Officer, praised the company’s resilience in the face of economic challenges. Despite the foreign exchange loss, EBITDA increased by 9.6 percent to N169.3 billion, reflecting the company’s confidence in its business prospects and evolving strategy for growth.