The Nigerian economy finds itself engulfed in a turbulent situation after a series of policy changes initiated by the government, resulting in a rapid escalation of prices, widespread inflation, and heightened economic instability.

Punch reports that the consequences of these decisions have profoundly impacted the lives of citizens and businesses alike.

Removing subsidies on petroleum products, notably the hike in petrol prices, triggered a cascading effect throughout the economic fabric.

Within days, the fuel cost surged from N200 to over N600 per litre, doubling the prices of essential goods and services across the market.

This sudden shift significantly burdened the economically disadvantaged, exacerbating the cost-of-living crisis and pushing millions towards the brink of poverty.

Adding to this upheaval, the Central Bank’s directive to remove rate caps on the naira led to an immediate devaluation. The national currency plummeted by 40.97% against global currencies, swiftly intensifying inflationary pressures due to Nigeria’s heavy reliance on imports.

The consequences of these policy changes manifested in various sectors, with businesses bearing the brunt of increased production costs and currency devaluation.

Manufacturers reported substantial losses, attributing job cuts and surging unsold inventory to diminished consumer purchasing power, inflationary pressures, and disrupted supply chains.

Key industry players such as Nestle Nigeria, Dangote Cement, and Nigerian Breweries faced substantial foreign exchange losses, totalling billions in combined deficits.

The manufacturing and services sectors experienced contractions, leading to price hikes across diverse industries, from beverages to digital services.

The relentless wave of price increases continued as major companies, including Google, Nigerian Breweries Plc., and Multichoice Nigeria, adjusted their prices upwards to offset currency devaluation and inflation losses.

Notably, subscription fees for various satellite television services and digital platforms soared, reflecting the ripple effect of economic instability.

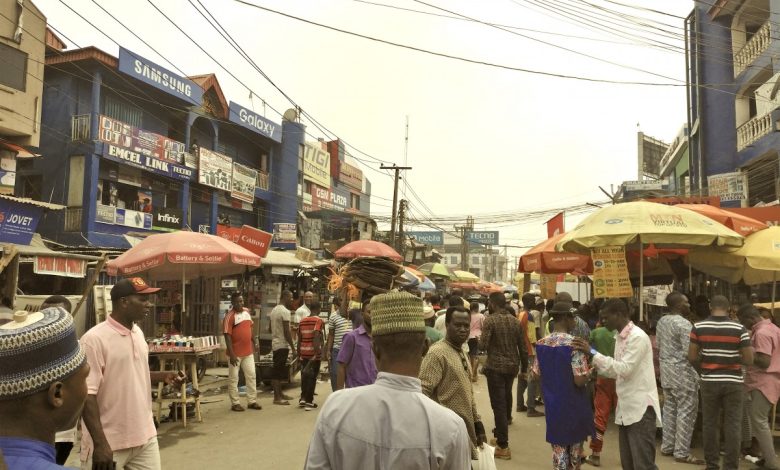

This economic turbulence has not only impacted businesses but also jeopardized the survival of many. Small and medium-sized enterprises, reliant on imported raw materials, struggled to cope with soaring costs, diminishing consumer spending, and eroding purchasing power.

Economic experts and industry leaders voiced concerns about the viability of businesses in this volatile climate.

The Director-General of Nigeria Employers Consultative Association, Mr Wale Oyerinde, said, “It is no gainsaying that the operating environment for many businesses has not been favourable, made worse by the ongoing challenges.”

On his part, the Chairman of the Nigerian Association of Small and Medium Enterprises, South-West, Dr Solomon Aderoju, declared, “When the SMEs produce, they won’t be able to sell because the purchasing power is eroding and people are not buying.

“Some of us import our raw materials from other countries, which means the cost of raw materials will also be mounting. These problems will kill SMEs.”

They highlighted the looming threat of closures, unemployment, and the broader repercussions on the educational sector due to restricted access to foreign exchange.