In a bid to curb the Naira’s freefall, the Central Bank of Nigeria (CBN) has clamped down on commercial banks, accusing them of hoarding foreign currency to profit from the depreciation.

The CBN issued fresh guidelines on Wednesday, titled “Harmonisation of Reporting Requirements on Foreign Currency Exposures of Banks,” aimed at curbing speculation and hoarding.

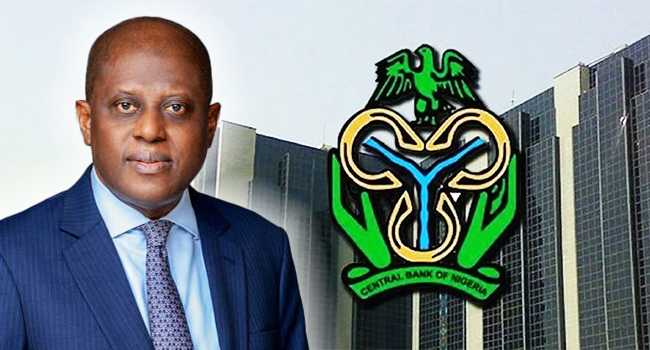

The circular, signed by Directors of Trade and Banking Supervision Hassan Mahmud and Rita Sike, comes as the Naira tumbles against the dollar, hitting a 42% decline in just two days.

“The Central Bank of Nigeria (CBN) has noted with concern the growth in foreign currency exposures of banks through their Net Open Position (NOP). This has incentivized banks to hold excess long foreign currency positions, which exposes banks to foreign exchange and other risks. Therefore, the CBN issues the following prudential requirements to ensure these risks are well managed and avoid losses that could pose material systemic challenges.”

“For example, a bank borrows or buys $ 1 million worth of forex but then holds half of it in its position instead of lending it or using it to finance purchases for its clients immediately.

“What this means is that banks can profit from currency depreciation if they buy the forex low and sell high”, it stated.

Also, the CBN added that “banks with current NOPs exceeding these limits must adjust their positions to comply with the new regulations by February 1, 2024.

“Additionally, banks must calculate their daily and monthly NOP and Foreign Currency Trading Position (FCT) using specific templates provided by the CBN”.