When the Nigerian President, Bola Ahmed Tinubu, was sworn in on May 29, 2023, his first policy intervention in Nigeria’s opaque, corruption-laden oil sector surprised everyone. “Subsidy is gone!” Tinubu exclaimed during his inaugural address at the Eagles Square, Abuja, shortly after he was sworn in as the 16th President of Nigeria. He added that there was no provision for subsidy in the national budget from June 2023 and, therefore, it stood removed.

If international investors had any doubt about Tinubu’s commitment to combat Nigeria’s hydra-headed corruption and sanitise the nation’s economic policy space, the declaration indeed put paid to it, and signalled his intent from the start.

Not relenting in its reform drive, barely a month after the subsidy removal declaration, the Tinubu government through the Central Bank of Nigeria (CBN) announced the unification of all segments of the forex market collapsing all windows into one. The bank said it was part of a series of immediate changes to operations in the Nigerian Foreign Exchange (FX) Market, in a bid to improve liquidity and Naira stability.

In its reaction to the raft of policy reforms, the International Monetary Fund (IMF) applauded the economic reforms, noting that the measures were a pathway towards stronger and inclusive growth.

A former President of the World Bank, David Malpass, also lauded the economic strategies employed by Tinubu since assuming office. In a tweet, Malpass declared: “Glad to see @officialABAT taking concrete steps to scrap Nigeria’s harmful government subsidies and multiple exchange rates. These are important steps toward currency stability, lower inflation, and reduced corruption in Africa’s most populous country.”

As in all reforms, the ripple effects of the policies are being felt across boardrooms and on the streets, even as government remains optimistic about the long-term benefits.

While the reforms have shown the direction of the Tinubu government’s economic policy, they have also shown how audacious the president can be in driving reforms in the interest of Nigerian poor masses, without giving undue advantage to businesses considered “sacred cows”.

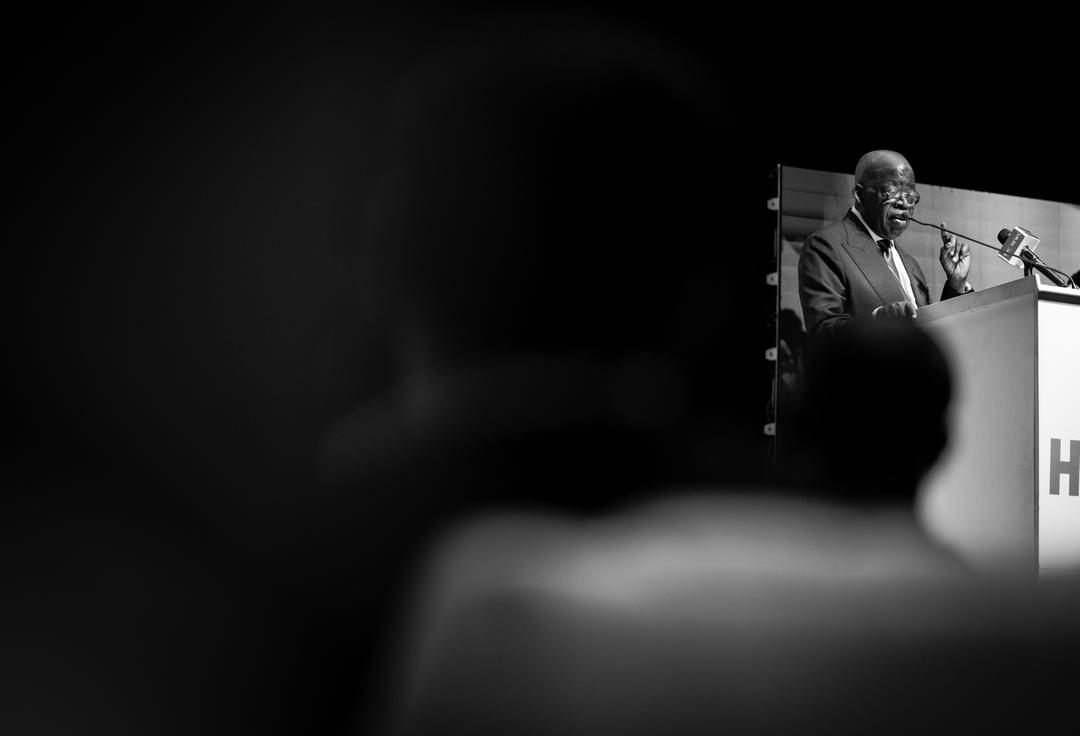

Tinubu himself made this known at a civic reception organised in his honour by the Lagos State Government at Lagos House, Marina, last October.

“I could afford to share the benefit by participating in the arbitrage, but God forbid! That’s not why you voted for me,” Tinubu said at the reception, defying the possible impact of the audacious moves on public sentiment.

“We have no choice,” he added, noting that it’s important to ensure the good use of available resources to unable government “re-engineer the effectiveness of the control and management of our resources in order to meet the obligations to Nigerians by political officeholders.”

The Price of Audacity

Last week, officials of the Economic and Financial Crimes Commission (EFCC) visited the Dangote Group headquarters in Lagos as part of an investigation into forex allocation in the past years.

Dangote Group is one of Africa’s largest companies owned by Billionaire businessman, Aliko Dangote.

The move was part of the ongoing investigation into the abuse of the foreign exchange allocations by former CBN governor, Godwin Emefiele, under whom reports said there were preferential foreign exchange allocations made in defiance of extant financial rules and regulations, and the CBN Act.

Already, Emefiele is being charged for gross violation of extant laws and abuse of office, according to a report by Jim Obazee, a Special Investigator appointed by President Bola Tinubu to scrutinise the activities of the CBN under the former CBN Governor.

The Obazee report, as seen in national dailies and which is yet to be made official, alleges that Emefiele employed surrogates to obtain shares in a new-generation bank during his tenure at the helm of the Central Bank of Nigeria (CBN). Other accusations in the alleged report against Emefiele encompass a spectrum of financial misdeeds, including unauthorised funding of 593 offshore bank accounts, fraudulent cash withdrawals from the CBN vault, gross financial misconduct involving the former governor and his Deputy Governors, and substantial fixed deposit holdings amounting to £543.4 million.

He is also accused of manipulations of the Naira exchange rate, irregularities in the e-Naira project, unauthorised printing of new currency denominations, and substantial expenditures on dubious legal fees, fraudulent interventions, COVID-19-related irregularities, and misrepresentation of presidential approvals on various financial strategies.

Since the recent EFCC investigations began, there have been concerns on how the optics of such investigations could affect the business environment and possibly scare investors away.

But could a move to sanitise the system, curb corruption, instill discipline and provide level-playing fields for all businesses indeed jeopardize investment and scare away investors?

Like BAT, Like MBS

The fears around President Bola Ahmed Tinubu’s reforms are reminiscent of similar fears around a sweeping crackdown on corruption ordered by Crown Prince Mohammed bin Salman, also known as MBS, in Saudi Arabia.

When the reforms began, reports premised on scaremongering dominated media headlines as many wondered what the ripple effect of the reforms could mean for the Saudi economy.

But against the background of the reforms, outlined in the Kingdom’s Vision 2030 blueprint, Saudi Arabia is all set to become one of the most sought-after destinations for businesses in the Middle East and North Africa region.

44 international companies have already moved their regional headquarters to Saudi Arabia, according to official figures, with the prospects improving by the day. At least 80 firms have been issued regulatory clearances to establish their offices in the Kingdom, too.

In recent months, several noted firms, including PwC Middle East and Egypt’s Intella, inaugurated their regional headquarters in Saudi Arabia, indicating Saudi Arabia’s investment-friendly evolution.

In Nigeria, a PwC report on the impact of corruption shows that corruption in Nigeria could cost up to 37% of Gross Domestic Products (GDP) by 2030 if it is not dealt with immediately. This cost is equated to around $1,000 per person in 2014 and nearly $2,000 per person by 2030.

What can be deduced from the report is that Nigeria cannot attain economic development and inclusive growth that will lift millions of Nigerians out of poverty until corruption, especially in business environment, is fought head-on.

So far, with the probe of the CBN, cancellation of round-tripping through the abolition of multiple exchange windows, and removal of opaque, unsustainable fuel subsidies, the Tinubu government has shown a rare commitment to fighting corruption and ensuring a fair investment ecosystem—one that gives investors equal access and opportunities irrespective of where they come from. Without doubt, this has sent positive signals to investors and businesses (local and foreign) worried about Nigeria’s sometimes opaque systems.

To quote a Bloomberg publication on corruption, “Graft may always be with us, but governments can choose either to tolerate and even assist it, or to confront it vigorously.” Will the Tinubu government continue on this pathway of sanitising endemic corruption or will it bow to scaremongering by vested interests?

Dumebi Ifeanyi is a senior public affairs analyst for Communications and Digital Engagement Nigeria