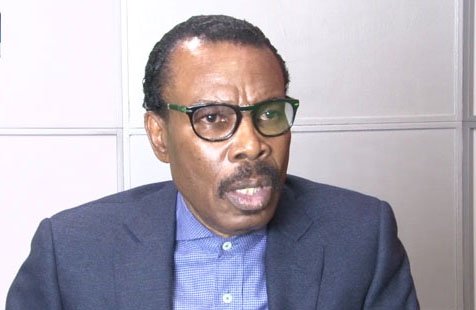

Bismarck Rewane, managing director of Financial Derivatives Company (FDC), has urged the Nigerian Labour Congress (NLC) to reconsider its stance on benchmarking the minimum wage demand on dollar exchange rate.

Rewane, who is also the chairman of FCMB, noted that a high minimum wage would result in massive job layoffs, especially among the private sector operators, who are the major employers of labour.

He disclosed this at the 2024 Annual Vanguard Economic Discourse with the theme: “Reform in an era of Global Economic Uncertainty: Whither Nigeria”, in Lagos.

The renowned banker argued that the private sector operators are currently confronted with several other macroeconomic challenges that erode their revenue, saying that they can only pay the minimum wage from the revenue.

“In 2019, the original proposal that we met, when Buhari called us, I could recall, was N18,000, and the discussion was around N24,000. I think we moved it to N30,000 after all negotiations,” Rewane said.

“When we came up, he said, I don’t want any layoffs, I don’t want any inflation, I don’t want this, and I don’t want that. But what do you want? That was not there.

“In any case, we were able to resolve the issue. The data is very clear on what we did, N30,000 was the minimum wage, which covers 10% more than N30,000 that the civil servants got.

“The equivalent at that time was about $75. So, for any other person, if you are on N18,000, you get N30,000. If you are a permanent secretary, whatever it is, you get N10,000 more.

“And the data is here. Inflation in 2019 was 11.4%. Inflation in 2020, the year after, came down to 6%. So, you can see that even though there was a wage review, which went from N18,000 to N30,000, inflation actually declined to 6 percent.

“So, it was well managed, anticipated, and the discussion was very thorough and it happened in the month of the election. The president signed on April 18th.

“So, if you now dollarise the minimum wage, because the inflation has already been factored in the exchange rate, you dollarise the income.

“And now, if you use the dollar value, you must also then use U.S. inflation. You cannot use the dollar value and then use the Nigeria inflation because that means that I am paying you in dollars.

“So you now use U.S. inflation, which is at 3.4 per cent now, and you take all the weight out of it. Let us say the U.S. inflation from 2019 to now went up to about 9 per cent. So let’s say everything put together was 15%, so, if you take the dollar value and add 15% to that, and then bring it back, you will find that there is enough room for you to come up with a midpoint.”

“Speaking about minimum wage, productivity in the US and our productivity in Nigeria are two different things. So that’s one.

“Two, the national minimum wage is a law that affects both the private sector and the public sector. It is a policy; it is not an economic plan, not a public plan. The government’s contribution to the GDP is about 10 per cent. The private sector, and the employers, also have to pay the minimum wage.

“They can only pay the minimum wage from the revenue they generate and you know the situation in this country. And they don’t want a situation which would lead to a recession. So, what I’m saying is that you negotiate the minimum wage bearing in mind that it is not government and government workers.

“The private sector is also in. Look at the losses they have been declaring and these companies that are going to borrow money at a higher interest rate are still going to pay a higher minimum wage.And so, we are very concerned about the growth of our investment.”

Rewane maintained that for efficient price reforms to be achieved, it must be preceded by institutional reforms that would ensure that the right set of people are emplaced in positions of authority.