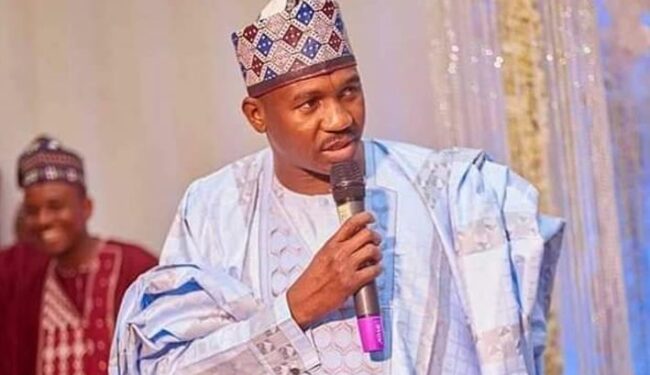

The governor of Sokoto State, Ahmed Aliyu is saddened by the alleged killing of about 10 residents of Gidan Sama and Rumtuwa villages in Silame Local Government Area of the state by a military airstrike on Christmas day.

Aliyu in a statement issued on Thursday, December 26, said he is communicating directly with the military top brass to ensure that such incident does not reoccur.

He also assured that his administration is putting all measures in place to ensure that the surviving victims, their families and those of the residents killed in the airstrike are given all the support they need.

According to the governor, he is working with the Nigerian Army to ensure thorough investigation into the unfortunate incident.

Aliyu said, “This heartbreaking event, caused by an accidental misfire from the Nigerian Army, has claimed the lives of innocent citizens and left several others injured.

“As your governor, I am deeply saddened by this avoidable loss of life. On behalf of the government and the people of Sokoto State, I extend my heartfelt condolences to the families who have lost their loved ones. We also pray for the swift recovery of those injured in this unfortunate incident,” Aliyu said.

Describing the incident as a “military misfire”, governor further announced a donation of N20 million and 100 bags of assorted food items to the families of the deceased.

He said the support from his office will aide in alleviating the suffering of those directly or indirectly affected by the airstrike.