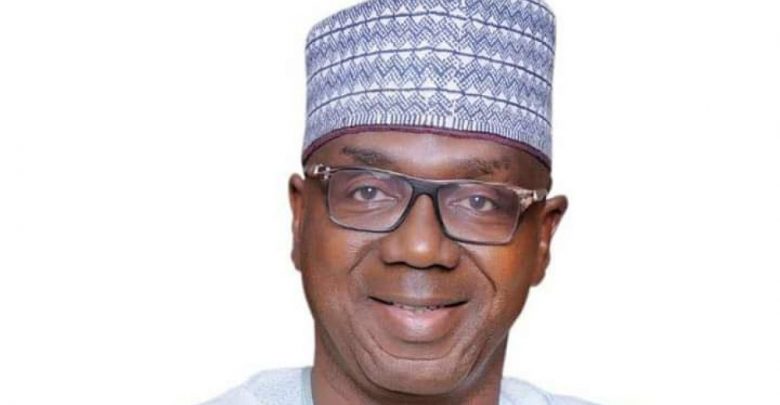

Kwara state governor, AbdulRazaq Abdulrahman, has said that the state government is discussing with the Central Bank of Nigeria (CBN) to lend money to those who want funds above N250,000 to support their businesses through the bank’s Anchor Borrowers Scheme.

He made this known on Wednesday via a statement signed by his Chief Press Secretary, Rafiu Ajakaye.

Mr AbdulRazaq stated that his administration is determined to right the wrongs of the past, invest in human capital and physical infrastructural development, and improve the living standards of the people.

“We are in government to serve our people. We have made commitments and we will not disappoint. We were here a year ago to campaign for you and you supported us. Let’s do it again this Saturday by voting Adam Ahmed Rufai of the APC during the by-election,”

“We come with a solid team headed by myself, the speaker, Deputy Speaker of the House of Assembly, former Speaker Benjamin Isa and other key stakeholders in the party. So, I can assure you that Adam Ahmed Rufai is in good company and will be supported in the Assembly.”

Accompanied by top government officials and party chieftains, AbdulRazaq had on Monday flagged off a marathon campaign tour that touched all the affected 10 wards of Patigi where he pointed out his various developmental strides in the local government and elsewhere in the state since his inauguration last year.

He pledged that the government would give the necessary support to farmers by providing farm implements, chemicals and funds to improve yields to guarantee food security.

“We are aware that some communities do harvest three times in a year. Come with your specific demands on the type of suitable farm implements and we will support you,” he added.

He added that the Social Investment Programme, which is due for launch anytime soon, would support smallholder farmers, artisans, small business owners, particularly women, and boost people’s purchasing power.

Anchor Borrowers Programme

The Programme which was launched by President Muhammadu Buhari in 2015 intended to create a linkage between anchor companies involved in the processing and small holder farmers (SHFs) of the required key agricultural commodities by providing them loans.

The Programme evolved from the consultations with stakeholders comprising Federal Ministry of Agriculture & Rural Development, State Governors, millers of agricultural produce, and smallholder farmers to boost agricultural production and non-oil exports in the face of unpredictable crude oil prices and its resultant effect on the revenue profile of Nigeria.

The loans are however disbursed through any of the Deposit Money Banks (DMBs), Development Finance Institutions (DFIs) and Microfinance Banks (MFBs), all of which the programme recognises as Participating Financial Institutions (PFIs).

According to the guidelines of the programme, upon harvest, benefiting farmers are expected to repay their loans with harvested produce (which must cover the loan principal and interest) to an ‘anchor’ who pays the cash equivalent to the farmer’s account.

The anchor could either be a private large-scale integrated processor or a state government. In the case of Kebbi, the state government is the anchor.

Upon kickoff, the programme got its takeoff grant from the N220 billion Micro, Small and Medium Enterprises Development Fund (MSMEDF). Farmers get loans at nine per cent interest rate. They are expected to repay based on the gestation period of their commodities.