Mixed reactions have continued to trail the invitation of two secular musicians for a forthcoming event a Celestial Church of Christ branch in Lagos.

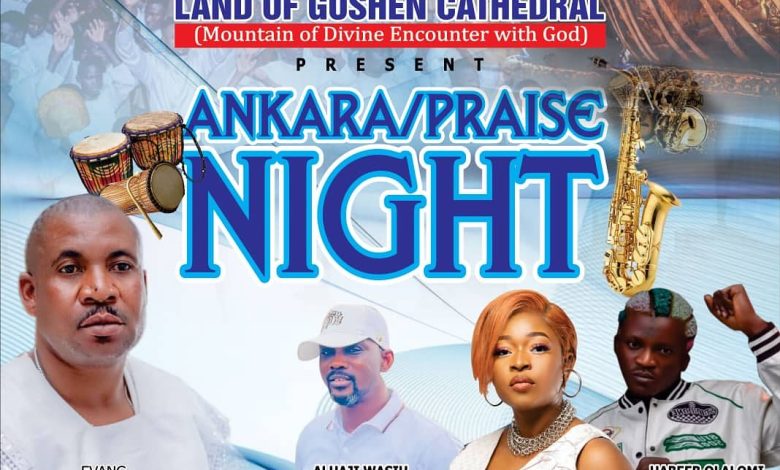

The event poster which surfaced on the internet on Wednesday showed that the church had invited Fuji singer, Pasuma, and street-hop artiste, Portable, to its praise night event.

A Facebook user, Bolanle Bamidele Adewuyi, wrote, “This is disheartening… Is this what you turn the Church of God to? It’s hilarious.”

Another commenter, Festus Olanrewaji Ojo wrote, “This is a shame! Shame and a very big shame.”

“This is totally nonsense,” Bu Kola commented.

Ayo Ife wrote, “The artists are not complete yet Una for kuku add Naira Marley so that the soul winning can be complete!”

Edafe Oghenebrume said, “This is a sacrilege in the Celestial Church of Christ. It is disheartening, pathetic, shameful and disgraceful. I wonder about the spiritual orientation of your Shepherd-In-Charge and the congregation.”

Becky Wunmi Hassan Ayoade added, “There is nothing they will not turn celestial church to.”

However, some netizens noted that they would be present for the event.

Abike Ade said, “I will surely be there.”

Another Facebook user, Abike Garment, wrote, “I must be there make I come dance away my sorrow.”