The presidency has revealled that about 50 percent of taxes paid by Nigerians end up in the pockets of private individuals.

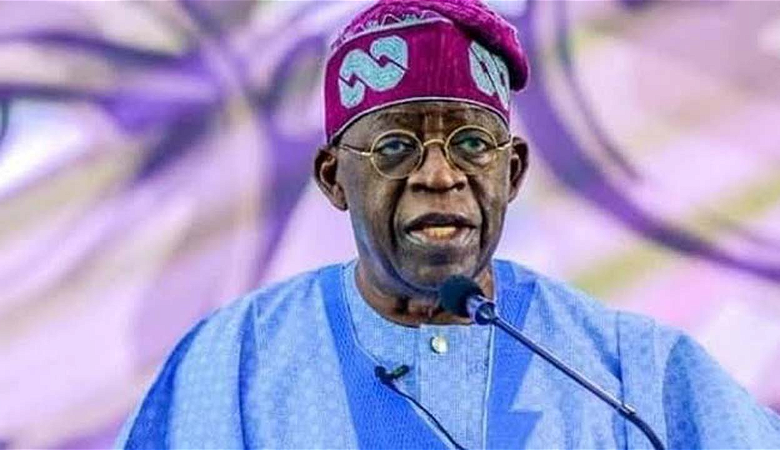

Special adviser to President Bola Tinubu on economic affairs, Tope Fasua, disclosed this in an interview with ChannelsTV on Tuesday, October 24.

Fasua advised governments at both federal and state levels to use technology, intelligence and a carrot-and-stick approach to increase revenue.

Hi noted that the Federal Inland Revenue Service (FIRS) may generate more than $14 million at the close of 2023 if the government puts in place relevant measures to block leakages in the system.

“One of the things to do to reduce this hurt [on Nigerians] is to drive revenue. I happened to be in the fiscal and tax committe and we have seen that without increasing taxes at all 50 percent of revenues of the country go into people’s pocket,” he said.

“Fifty percent of taxes, revenues, rents, rates, fees, from whatever is due to the government across board: national and subnational, go into people’s pocket because of several infractions and indiscipline.

“If this can be solved, maybe the FIRS would close the year with 14 to 15 trillion. Look at what FCT is doing since Mr Wike got into government. He looked into his book and saw that nobody was paying ground rent in the FCT.

“The man is going to be tripling his revenue this year. In the last NEC meeting, the Vice President also charged the governors to look at what Wike is doing and go back to their states and also see what they can do to ensure they get something back from the people.

“If the government can use technology and intelligence and also use carrot and stick [approach] and show some people the gaol of serious fines, everybody will sit up. That is what we need; we don’t need to increase taxes.”