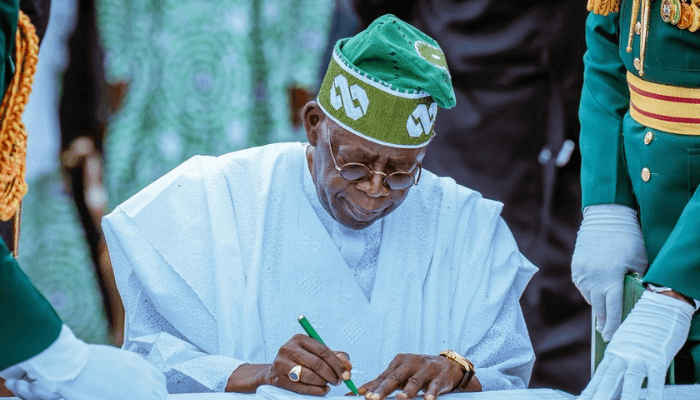

The Federal Government’s proposed Tax Reform Bill, spearheaded by President Bola Ahmed Tinubu, seeks to introduce a consumption-based Value Added Tax (VAT) model.

The plan, which aims to address long-standing revenue allocation disparities, has ignited national debate over its potential impact on regional equity and economic development.

During a House of Representatives session, Dr. Zacch Adedeji, Executive Chairman of the Federal Inland Revenue Service (FIRS), explained the rationale behind the reform.

“VAT is a consumption tax,” he stated. “Its revenue should reflect where goods and services are consumed, not where transactions are recorded.”

Currently, states like Lagos dominate VAT collections, accounting for 42% of national revenue, followed by Rivers (16%) and the Federal Capital Territory (9%).

Meanwhile, less industrialised states such as Borno and Bauchi receive less than 0.5%. Under the new model, revenue allocation would prioritise population-based consumption over production hubs.

Supporters, including Arabinrin Aderonke Atoyebi, a media aide to Dr. Adedeji, believe the reform will empower underserved states.

“This change could enable these regions to invest in critical areas like healthcare, education, and infrastructure,” she remarked. Advocates argue that equitable distribution will foster national unity and sustainable growth.

However, opposition from Lagos and Rivers reflects concerns over potential budgetary shortfalls. Critics fear the reform could delay essential projects and disrupt public services in states that currently benefit the most.

Dr. Adedeji maintains that the reform aligns with President Tinubu’s Renewed Hope Agenda, promising a fairer Nigeria. “This is about creating a nation where every region can thrive,” he said.

Though contentious, the proposed VAT model highlights an effort to create a more balanced approach to revenue sharing, offering a vision of economic inclusivity and regional development.