Wema Bank, one of Nigeria’s commercial lenders, is at the centre of a ₦8.5 billion cyber fraud scandal that is raising regulatory alarms and unsettling investors.

The Economic and Financial Crimes Commission (EFCC) recently arraigned seven individuals, including three Wema Bank employees, for their alleged involvement in a sophisticated cybercrime scheme involving large-scale fund diversion and data manipulation.

According to the EFCC, the heist occurred in January 2025 and is considered one of the most brazen breaches of trust in Nigeria’s banking sector in recent years. POLITICS NIGERIA learned that the accused employees allegedly conspired with four external collaborators to defraud the bank and erase sensitive customer data.

Since the news broke, Wema Bank PLC share price on the Nigeria Stock Exchange has fell by 3.76%, closing at N12.80 per share on Wednesday.

Two sources familiar with Wema Bank’s internal structure told Politics Nigeria that the scandal has severely shaken investor confidence and could threaten the bank’s ongoing recapitalisation efforts.

Last week, the bank announced plans to raise ₦50 billion through a private placement following the conclusion of its ₦150 billion rights issue on May 21. Both capital-raising moves are part of Wema’s strategy to meet the ₦200 billion minimum requirement set by the Central Bank of Nigeria (CBN) for banks with national licenses.

Another growing concern is the bank’s exposure to potential lawsuits and regulatory penalties stemming from the customer data breach. The Nigeria Data Protection Commission (NDPC) has intensified its scrutiny of the financial sector after fining Fidelity Bank ₦555.8 million last year for violating the Nigeria Data Protection Act.

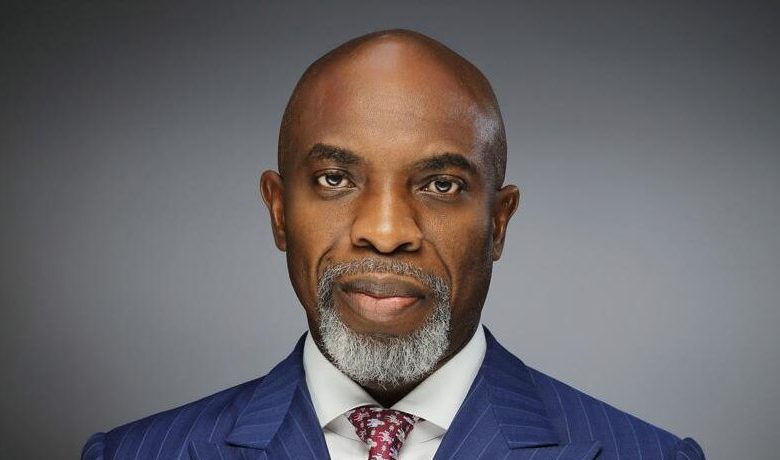

Oseni in the Eye of the Storm

While the bank has remained largely silent, internal sources say attention is now focused on Managing Director and CEO, Moruf Oseni, under whose watch the fraud occurred.

Oseni, who has led the bank for more than a decade, may face pressure to resign amid concerns over repeated security failures. Wema Bank reported a ₦685 million loss from 1,195 fraud and forgery cases in 2023, according to its audited financial report submitted to the Nigerian Stock Exchange.

“With these recurring breaches, questions are being raised not just about the bank’s internal systems but also about the competence and accountability of its leadership,” said a management staffer.

“This is not just a rogue staff issue,” a financial analyst said. “It is a systemic failure that begins at the top. When fraud of this scale can happen, it means governance is either weak, complicit, or grossly negligent.”